[ad_1]

Dividend shares with excessive yields are sometimes a pink flag. When buyers do not belief the dividend, the share worth falls, and the yield rises abnormally excessive. An organization that persistently raises its dividend is a inexperienced flag. Rising dividends sign administration’s confidence within the enterprise.

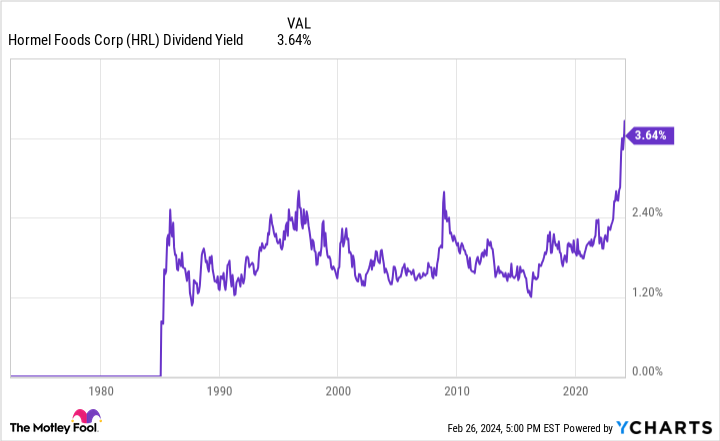

So, what occurs when a Dividend King, a inventory with 50 or extra years of consecutive dividend development, trades at its highest-ever dividend yield? That is the place Hormel Meals (NYSE: HRL) finds itself right this moment.

The query is whether or not Hormel’s yield is an alternative or a lure.

Here’s what you could know.

Hormel’s latest adversity

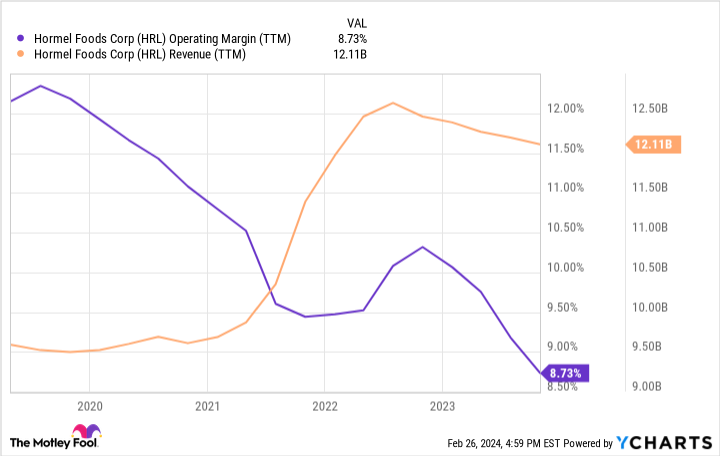

Hormel Meals sells a wide range of packaged meals and meats to retailers and eating places worldwide. A few of the firm’s best-known manufacturers embody Spam, Skippy, Planters, Jennie-O, and Hormel-branded meat merchandise. The corporate has been in enterprise for generations, however you possibly can see under how income and operating margins have trailed off just lately. Observe that the massive bounce in income was attributable to buying Planters in 2021.

What is the perpetrator? The pandemic induced provide chain disruptions and inflation to stress Hormel in 2022, which continued in 2023. Administration has cited operational modifications and investments to deal with the availability chain issues. This transformation, as administration calls it, may create a further $250 million in working earnings by 2026.

Moreover, Hormel has handled difficult points like fowl flu and a gentle market hurting its worldwide enterprise, particularly in China. Happily, administration is hoping this begins to recuperate within the fourth quarter of 2024. Hormel ought to in the end be judged on its monetary power, as a result of it could’t management one thing like fowl flu or broad weak point out there.

A strong begin to 2024

Administration had some good issues to say when Hormel just lately reported its earnings for the quarter ended Jan. 28. The corporate reaffirmed full-year steering, citing development in its meals service section and the anticipated rebound in worldwide gross sales. Quantity did bounce 11% year-over-year on increased exports, so this could carry by way of to gross sales development because the Chinese language market rebounds.

The corporate’s working margin did drop to 9.5% from 9.7% within the year-ago interval, however buyers ought to search for that to begin turning round. The provision chain transformation is anticipated to be a modest earnings contributor in 2024, so it ought to begin to make a much bigger impression over the following two years and past.

Total, it is a strong begin to Hormel’s fiscal 12 months 2024. The following three quarters can be necessary for exhibiting numbers to help the notion that Hormel’s actions to enhance its profitability are bearing fruit.

Is the dividend protected?

For now, Wall Road appears reluctant to provide Hormel the advantage of the doubt. You possibly can see that Hormel’s yield has by no means been this excessive. Over the previous 5 years, the inventory worth has dropped and the dividend has risen. Is Hormel’s monetary situation as dire because the dividend yield would have buyers imagine? Nicely, probably not.

The dividend payout ratio is at 76% of money circulate, leaving the corporate wiggle room to pay the dividend. The corporate’s working earnings was roughly $1 billion over the previous 12 months, and $777 million was free money circulate. Hormel’s dividend can have loads of respiration room if administration achieves its objectives to develop working earnings.

Moreover, the steadiness sheet is in fantastic form. Administration has historically been conservative with debt, although it made an exception when it purchased the Planters nuts model for $3.35 billion in 2021. Even now, although, leverage is simply 1.9 instances internet debt to EBITDA. That is nicely under the three ratio I typically begin to fear about.

The decision is…

There is no doubt that Hormel goes by way of some bumps and bruises right this moment, however the firm stays very financially strong. This isn’t a yield lure. Hormel is a fantastic dividend inventory to purchase and maintain long-term. The market may even increase the inventory’s valuation as soon as it turns into clear that these challenges are previously.

As we speak, the inventory trades at a ahead price-to-earnings ratio of simply over 19. Analysts are presently down on the inventory, estimating mid-single-digit earnings development over the following three to 5 years. But when administration’s firm transformation boosts working earnings by $250 million, Hormel shouldn’t have any points outperforming analysts’ expectations.

Must you make investments $1,000 in Hormel Meals proper now?

Before you purchase inventory in Hormel Meals, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Hormel Meals wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of February 26, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

This Dividend King’s Yield Has Never Been This High. Time to Buy the Stock? was initially revealed by The Motley Idiot

[ad_2]