[ad_1]

In one of the troublesome to interpret set of public finance forecasts for a few years, chancellor Jeremy Hunt appeared each to have lots of money to splash and be tightly constrained by his fiscal guidelines.

However he additionally has a very good probability of having the ability to unveil an enormous pre-election giveaway by the autumn. It’s not shocking that one Tory official mentioned it was “a Funds for wonks” forward of Hunt’s assertion to parliament.

The chancellor claimed he was outlining a “Funds for progress”, having stabilised the general public funds by means of a £55bn a yr fiscal consolidation in his Autumn Assertion final yr that drew a line beneath the chaos of Liz Truss’s shortlived premiership.

He mentioned that his Funds measures would supply “long-term, sustainable, wholesome progress that pays for our NHS and faculties, finds jobs for younger individuals, and gives a security internet for older individuals all while making our nation one of the affluent on this planet”.

However the newest forecast by the Workplace for Funds Accountability means that the British economic system will develop just one per cent a yr on common between the eve of the coronavirus pandemic and the beginning of 2028.

That’s solely marginally larger than the 0.95 per cent common set out by the UK fiscal watchdog at Hunt’s Autumn Assertion in November.

Despite the fact that the expansion forecast is sluggish, the OBR’s prediction is each on the high finish of estimates by unbiased economists and much more optimistic than the Financial institution of England’s calculation.

It’s this progress optimism in contrast with different forecasters that prevented the general public funds from being holed under the waterline within the Funds.

However as a result of progress was hardly higher than within the OBR forecasts on the Autumn Assertion, the chancellor’s capacity to seek out new cash for costly gadgets — notably enterprise funding incentives, pension tax aid and childcare — stemmed largely from the fiscal watchdog’s predictions of upper tax revenues.

These income estimates are on common greater than £20bn each year larger than in November’s forecast for the 5 years beginning in 2023-24, giving Hunt what the OBR described as a “fiscal windfall”.

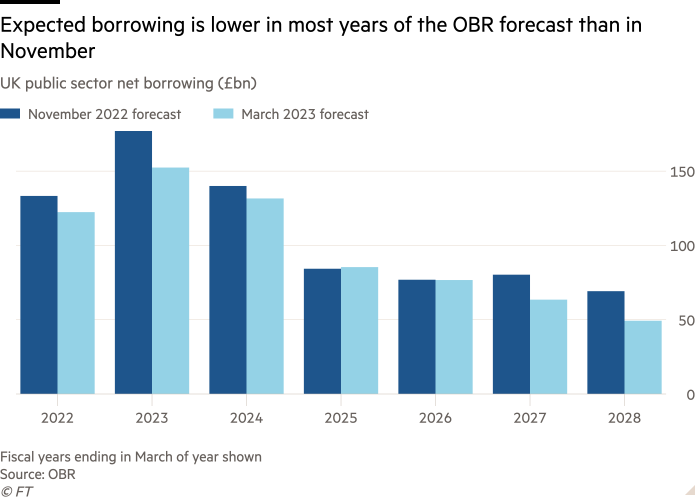

This windfall is much more evident within the OBR’s underlying forecasts, which had been a lot better than in November.

The OBR revised down its public borrowing expectations for 2022-23 by £24.5bn, and carried this by means of for the following 5 years of the forecasts. By 2027-28, the fiscal watchdog mentioned the underlying deficit could be solely £40.8bn, a lot decrease than the £69.2bn forecast in November.

As a substitute of accepting this massive enchancment in borrowing, Hunt selected to succeed in for the federal government’s cheque e-book.

However moderately than elevate public sector pay to finish widespread strikes, Hunt selected to present firms extra beneficiant capital allowances, present the well-off with enhanced tax aid on pension contributions, and supply free childcare to folks with one- and two-year-olds.

The OBR mentioned: “The chancellor has used two-thirds of his [windfall] on his Funds measures.”

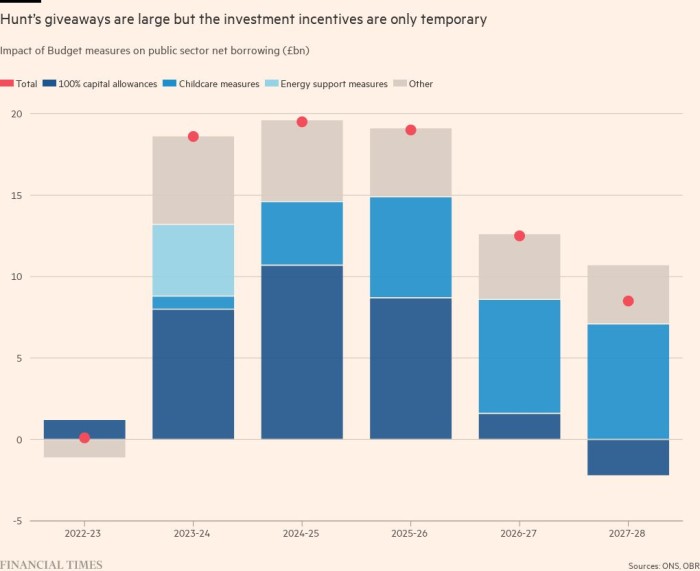

Unusually, the cash spent was not uniform throughout the years within the OBR forecasts.

There’s a massive bulge of £20bn of giveaways within the subsequent three years earlier than the handouts dip to about £10bn in 2026-27 and 2027-28.

This displays how Hunt’s coverage of giving firms the chance to write down off 100 per cent of their capital spending in opposition to taxable income lasts just for three years.

Hunt was prevented from hailing a everlasting “full expensing” of enterprise funding as a result of he was “hemmed in” by the operation of “his personal poorly designed fiscal rule”, based on Paul Johnson, director of the Institute for Fiscal Research, a think-tank.

This rule states that underlying public debt as a share of gross home product have to be falling by the fifth yr of the OBR forecast, and is predicted to drop by solely 0.2 share factors in 2027-28 within the fiscal watchdog’s newest predictions.

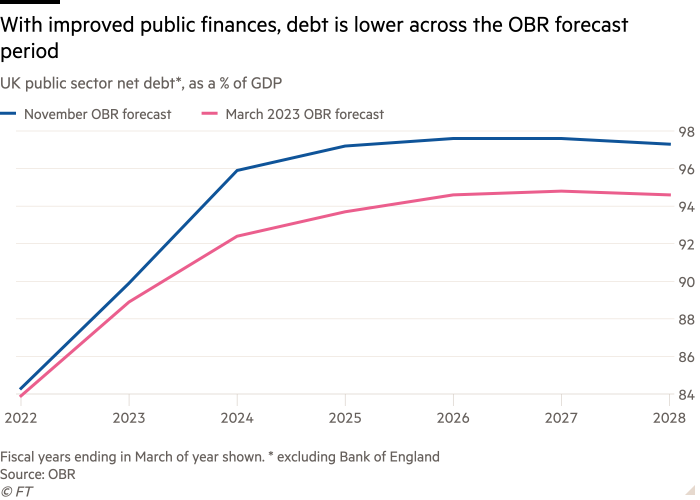

As Johnson made clear, the rule was odd as a result of the debt profile of the UK is objectively more healthy on this set of forecasts than these in November.

By 2027-28, internet public sector debt is anticipated to be 94.6 per cent of GDP, in contrast with 97.3 per cent predicted within the Autumn Assertion.

However the rule doesn’t take into account the extent of debt, and solely the change within the fifth yr of the OBR forecast.

It constrained Hunt as a result of the fifth-year progress forecast by the fiscal watchdog is now weaker in 2027-28 than it anticipated in November.

This made it tougher to have debt falling as a share of GDP. Hunt met his rule, based on the OBR, with simply £6.5bn leeway — a traditionally small quantity of headroom in opposition to the fiscal rule.

The outcome was that Hunt’s new capital allowances for firms are for now deemed non permanent.

If that was unhealthy information for the chancellor, the excellent news is that this constraint stemming from his debt rule will in all probability disappear within the autumn.

By then, the fifth yr of the OBR forecast will roll ahead to 2028-29, and that can make the rule a lot simpler to hit.

Even with none improved financial and public finance forecasts on the subsequent Autumn Assertion, the additional yr to hit the debt rule will give the chancellor important scope for future giveaways.

Sandra Horsfield, economist at Investec, mentioned that with the additional time and a good wind, the outlook would enhance for Hunt later this yr or in a 2024 Funds. “The chancellor will enter the following part of his fiscal technique, which will probably be to seek out room for a tax giveaway forward of a possible 2024 election,” she added.

The dimensions of the seemingly giveaway to return can’t but be estimated, however Treasury insiders are hopeful of a big package deal of tax cuts and cash to spice up the efficiency of stretched public providers.

Borrowing and debt for the remainder of this decade nonetheless seem difficult, however it seems like Hunt can now see a pathway to being seen as a Conservative chancellor who crammed a gaping gap within the public funds after which used a greater financial outlook to embark on a tax-cutting mission.

[ad_2]