[ad_1]

Obtain free Mergers & Acquisitions updates

We’ll ship you a myFT Day by day Digest electronic mail rounding up the most recent Mergers & Acquisitions information each morning.

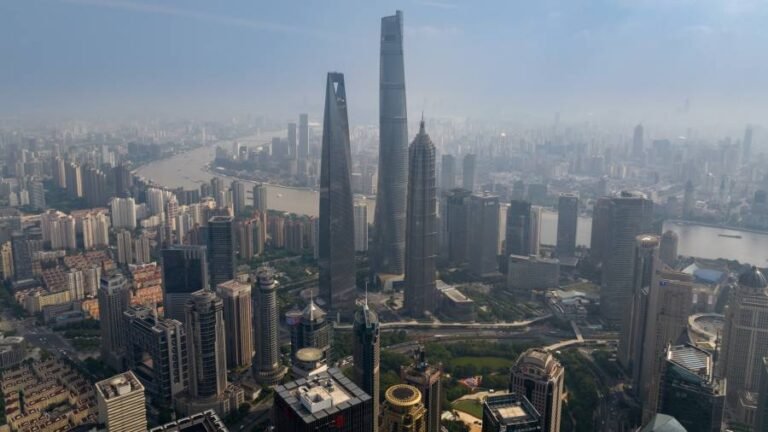

Chinese language deal exercise within the US has fallen to its lowest degree in nearly twenty years, in an indication of geopolitical tensions between the 2 international locations weighing on cross-border monetary exercise.

US merger and acquisition funding from China has totalled simply $221mn thus far this yr, representing the slowest tempo of funding since 2006, in response to knowledge from Dealogic. The entire at this level final yr was $3.4bn.

The determine contrasts with rising funding into mainland China and highlights the impression of geopolitics on a beforehand booming cross-border monetary sector that for years supplied a bridge for Chinese language companies into profitable western markets.

Apart from the US, Dealogic knowledge confirmed simply $189mn of Chinese language offers in Germany thus far this yr, the bottom quantity in additional than a decade, whereas exercise within the UK and Australia has totalled $503mn and $228mn thus far. There aren’t any recorded deal figures for Canada.

“This yr, a minimum of for the primary half, there’s not [been] that a lot exercise,” stated Crystal Zhang, a Shanghai-based companion at monetary agency Arc Group.

“There are issues which might be being labored on, however clearly volumes have fallen quite a bit, there may be extra regulatory intervention,” stated one banker at a number one worldwide financial institution in Asia, who spoke on the situation of anonymity and prompt future exercise can be “outdoors of the nationwide safety field”.

He pointed to the instance of the crucial minerals and metals industries, which grew to become topic to new restrictions by China last month. “There are a number of Chinese language corporations who would very very similar to to pursue M&A [in critical minerals] in Canada, Australia or North America. That appears tougher in this type of atmosphere.”

Relations between the US and China worsened this yr after the US shot down a suspected Chinese language spy balloon. The launch of a congressional committee on China has added to the scrutiny of enterprise relations, whereas the US has additionally imposed restrictions on Beijing’s access to semiconductor technology.

Chinese language outbound M&A has proven indicators of development in different elements of the world, equivalent to in Peru, the place Italian utility firm Enel this yr offered property to China’s Southern Energy Grid Worldwide for $2.9bn within the greatest outbound deal of the yr. The subsequent three largest offers have been in Singapore.

However the whole of just below $12.2bn invested thus far this yr contrasts with the tens of billions of {dollars} invested yearly for the last decade previous to the coronavirus pandemic. In 2016, China’s full-year outbound M&A peaked at $212bn, whereas in 2019 it was $54bn.

The coolness in outbound exercise contrasts with much less unstable inbound M&A offers on the mainland, which have picked up in current months and are thus far working at their quickest tempo since 2015, at $27bn this yr.

One supply of offers has been multinationals in search of to restructure or carve out their mainland operations amid the worsening local weather, trade members stated.

Alongside a harder local weather for M&A, overseas funding banks have additionally struggled to stay energetic in China’s huge preliminary public providing market, which is now utterly dominated by home gamers.

As of June, overseas banks had been involved in just 1 per cent of deals this yr.

[ad_2]