[ad_1]

The S&P 500 lately hit a brand new all-time excessive, closing at 4,840 on Jan. 19 and formally coming into bull market territory. A lot of its progress over the past yr may be attributed to a growth in synthetic intelligence (AI), which has seen many tech shares skyrocket. The sector has proven no indicators of slowing.

Information from Grand View Analysis reveals that the AI market is projected to increase at a compound annual progress charge of 37% till no less than 2030, which might see the business exceed a valuation of $1 trillion earlier than the tip of the last decade. It is not too late to speculate on this budding sector and revenue from its long-term improvement.

So, listed here are two AI stocks I am going “all in” on in 2024.

1. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) was barely ignored final yr as rivals Amazon and Microsoft appeared to progress quicker in AI. Nevertheless, the corporate was merely taking the time to hone its expertise because it ready to make a giant splash within the business in 2024.

Final December, Alphabet unveiled its extremely anticipated AI mannequin, Gemini. The brand new mannequin excels at constructing generative AI applications with its capacity to crunch numerous types of information, equivalent to audio, video, and textual content. The tech large has stated it is going to launch three variations of Gemini, with probably the most highly effective one designed to run information facilities and the smallest one in a position to energy smartphones.

Gemini may open the door to many progress alternatives in AI for Alphabet, with the expertise to create a Google Search expertise nearer to OpenAI’s ChatGPT, add new AI instruments to Google Cloud and Android, provide extra environment friendly promoting, and higher monitor viewing traits on YouTube.

Alongside Gemini, Alphabet introduced a brand new technology of its custom-built AI chips. The Cloud TPU v5p is a tensor processing unit (TPU) designed to coach massive AI fashions. It is practically thrice quicker than earlier variations.

Over the past 5 years, Alphabet’s annual income and working earnings have risen 75% and 106%. In the meantime, free cash flow has soared 151% to $77 billion. The corporate is without doubt one of the most dependable tech corporations and is simply simply getting began in AI, which may additional increase earnings within the coming years.

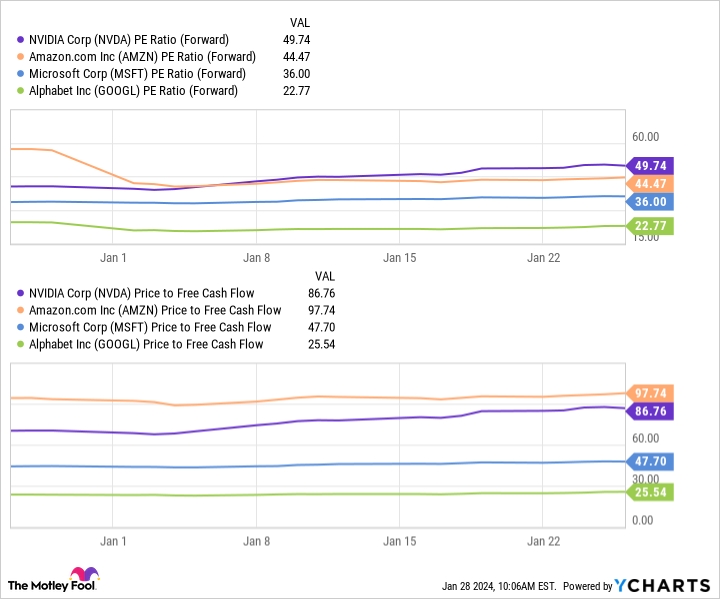

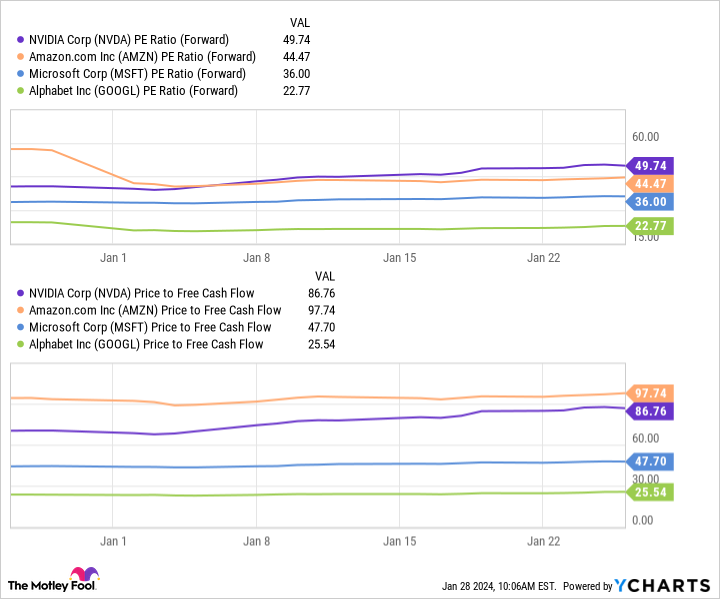

Furthermore, this chart reveals that Alphabet is without doubt one of the most cost-effective AI shares. The corporate has the bottom ahead price-to-earnings ratio (P/E) and price-to-free money circulate amongst among the most distinguished names in AI, indicating that its inventory affords probably the most worth.

Alphabet has the funds and model energy to go far in AI, making it a screaming purchase for me in 2024.

2. Superior Micro Gadgets

Chip shares captivated Wall Avenue final yr, and for good motive. These firms are creating the {hardware} vital to coach and run AI fashions, making them well-positioned to see main positive factors as demand for chips continues to soar.

Whereas Nvidia stole a lot of the highlight final yr, it’s value contemplating investing in chipmakers at earlier levels of their AI expansions, as they may have extra room to run. Superior Micro Gadgets (NASDAQ: AMD) is an thrilling choice because it gears as much as problem Nvidia in AI in 2024.

AMD unveiled its MI300X AI graphics processing unit (GPU) final December, saying that the chip is on par with Nvidia’s H100 GPU for coaching and that it beats the H100 for inference by 10% to twenty%. It is already attracting a few of tech’s greatest gamers.

In November, Microsoft introduced that Azure would change into the primary cloud platform to make use of the MI300X to optimize its AI capabilities. Microsoft has a partnership with OpenAI, making the corporate a robust accomplice for AMD. Alongside an settlement with Meta Platforms — which can see it use the brand new chips as nicely — AMD’s future in AI seems to be vivid.

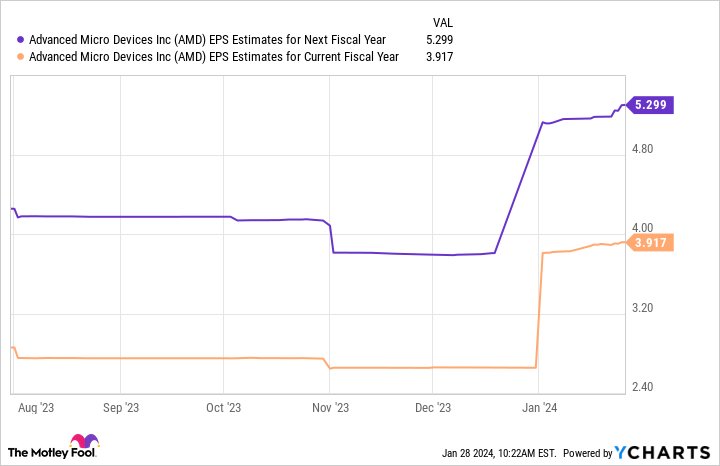

This desk reveals AMD’s earnings may hit simply over $5 per share by its subsequent fiscal yr. That determine, multiplied by the chipmaker’s ahead P/E of 45, yields a inventory worth of $239.

If projections are appropriate, AMD’s shares would rise 35% by the tip of fiscal 2024, outperforming the S&P 500’s enhance of 20% over the past 12 months. Alongside large potential in AI, AMD is without doubt one of the most fun funding alternatives this yr.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Alphabet wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of the S&P 500 since 2002*.

*Inventory Advisor returns as of January 22, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has a disclosure policy.

2 AI Stocks I’m Going “All In” On In 2024 was initially revealed by The Motley Idiot

[ad_2]