[ad_1]

A number of months after her wedding ceremony this yr, Lilian Li moved from the south-western Chinese language metropolis of Chongqing to an residence close to Beijing’s monetary district.

However whereas Chinese language newly-weds sometimes see property possession as a necessary subsequent step after marriage, Li and her husband are as a substitute renting a two-bedroom residence within the capital for Rmb13,000 ($1,821) monthly.

To purchase an equivalent residence, Li and her household would want greater than Rmb5mn only for the down cost — the equal of greater than 30 years’ lease.

“My husband and I had a deep dialog concerning the life we would like, and we reached an settlement to not purchase,” stated Li, 28. “We don’t need to owe our dad and mom a large down cost or to fall closely into debt.”

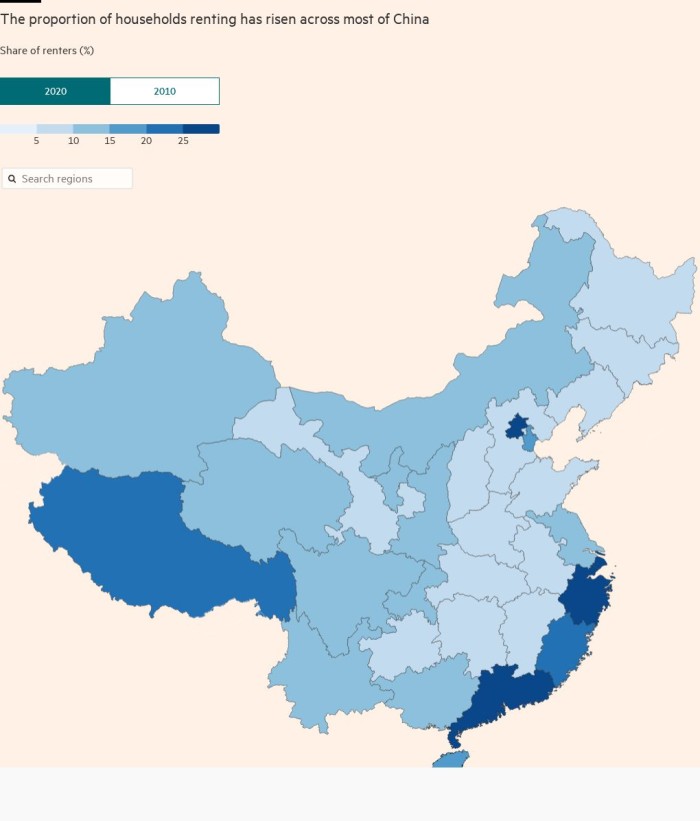

Growing numbers of younger Chinese language, the principle patrons of city properties, are making the identical choice — with doubtlessly far-reaching implications for the nation’s troubled property market.

Affordability is a thorny difficulty for homebuyers in China, the place common home costs have practically doubled over the previous decade. Rents have additionally elevated, however by a lot much less. The ratio of the price to purchase residential properties to their month-to-month lease was above 600 in main cities in June 2022, in accordance with calculations by actual property information agency Zhuge Zhaofang. In 2007, the ratio was 400 or beneath.

A ratio of greater than round 200 is taken into account a warning sign of a possible property value bubble, in accordance with a report by the Chinese language Academy of Social Sciences, a state think-tank.

In Beijing, the common residence now prices about Rmb69,000 per sq. metre, in accordance with actual property information supplier creprice.cn.

First-time patrons sometimes depend on household help and debt to buy a dwelling house in huge cities. However the woes of actual property builders reminiscent of Evergrande, which defaulted last year as a liquidity disaster gripped the property sector, have left many patrons with unfinished properties. That has prompted potential purchasers reminiscent of Li to query what has for many years been seen as China’s finest family funding alternative.

Chinese language dwelling gross sales by ground space in 100 cities had been down about 20 per cent yr on yr in October, in accordance with a survey by China Index Academy, an actual property analysis agency. Whereas gross sales haven’t fallen as quick in prime areas of massive cities, the pessimism throughout the market has dented confidence. And whereas new properties stay costly, common costs throughout 70 cities had been down 2.4 per cent in October from a yr in the past, the seventh consecutive month of decline, authorities information confirmed.

“With no wealth-creation impact, what’s the purpose of shopping for properties like loopy? Why not simply lease?” stated Victoria Zhan, a younger banker who has postponed plans to purchase an residence in suburban Shanghai this yr.

The analysis division of China Worldwide Capital Company forecast that the variety of Chinese language renting would develop by 200mn to achieve 300mn by 2035.

The cooling enthusiasm for homebuying comes as the federal government strikes to make extra inexpensive rented housing out there to younger individuals as a part of President Xi Jinping’s drive for “widespread prosperity”.

Authorities are pushing extra government-subsidised rental properties on to the market and have rolled out “accommodative policies” for the sector together with low-interest loans for builders of rental housing.

Qiqi Zhang, a Shanghai-based director at US personal fairness group Warburg Pincus, which first invested in rental property in China in 2013, stated excessive home costs in main cities nonetheless put “numerous stress” on younger individuals.

The federal government “actually needs to advertise rental housing to resolve the lodging wants of younger individuals”, Zhang stated.

In January, China’s housing ministry introduced a goal of 6.5mn items of inexpensive properties to be inbuilt 40 cities over the 5 years to 2025, sufficient to accommodate 13mn younger individuals and new residents.

The federal government’s promotion of the rental housing market is more and more intertwined with its help for property builders struggling to finish residential building initiatives.

Monetary regulators final month known as for elevated state-led conversion of unfinished properties to rental housing, and unveiled extra subtle monetary routes to assist banks and traders purchase out unfinished initiatives.

In response, the federal government of Kaifeng metropolis in China’s central Henan province stated it deliberate to purchase greater than 1,000 unfinished residences subsequent yr from Evergrande and switch them into rental properties.

Within the central metropolis of Xi’an, seven banks together with China Growth Financial institution and China Building Financial institution vowed to supply Rmb210bn credit score strains to help rental housing initiatives.

CCB, the nation’s second-largest financial institution by belongings, stated it had individually arrange a Rmb30bn rental housing fund to purchase out unfinished residential building initiatives in additional than 20 cities. Some initiatives had been purchased from builders at a 50 per cent low cost to the worth initially placed on the properties, a banker aware of the fund’s operation stated.

In a analysis observe, analysts at Morgan Stanley stated state promotion of renting was consistent with Xi’s 2015 name for housing to be “for dwelling not for hypothesis”. However, they wrote, “the method will take time, and can for now primarily function draw back help to the housing market”.

Li stated renting relatively than shopping for would save her and her husband cash and so assist them preserve their high quality of life.

“We are able to purchase an residence in Chongqing after we are getting outdated and able to retire,” she stated. “Earlier than that, I believe we’ll preserve renting in Beijing.”

[ad_2]