[ad_1]

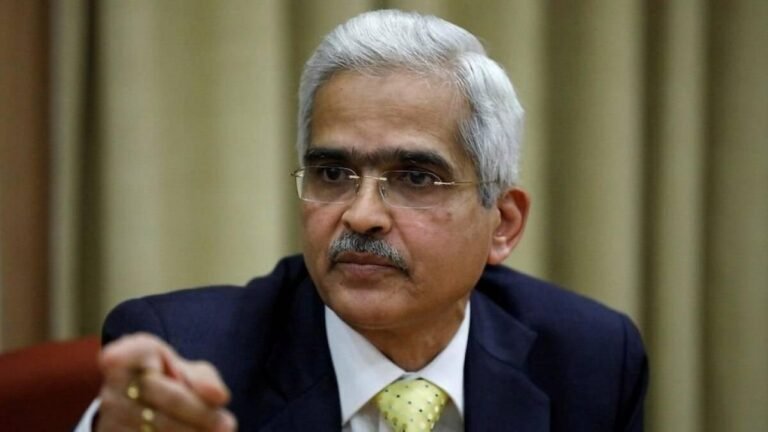

RBI MPC bulletins: Reserve Financial institution of India (RBI) pegged GDP progress at 4.4 per cent for Q3FY23 and 4.2 per cent for Q4FY23, Governor Shaktikanta Das stated in his financial coverage assertion on Wednesday. RBI had pegged GDP progress forecast at 13.5 per cent in Q1 and 6.3 per cent in Q2. The RBI additionally pegged actual GDP progress forecast at 6.8 per cent for FY23.

Transferring forward, the RBI boss acknowledged that actual GDP progress has been projected at 7.1 per cent for Q1FY24 and 5.9 per cent for Q2FY24 respectively.

“Meals, power safety along with local weather change have develop into largest challenges to the world. On this hostile surroundings, Indian economic system stays resilient, drawing energy from macroeconomic fundamentals”, Das stated. He added, “India is extensively seen as a vibrant spot in an in any other case gloomy world.”

Shaktikanta Das stated that inflation is predicted to stay above 4 per cent for the subsequent 12 months. Das stated CPI inflation forecast for October to December ’22 has been raised to six.6 per cent from 6.5 per cent.

The RBI raised CPI inflation forecast for Jan-Mar ’23 to five.9 per cent. The central financial institution retained CPI inflation forecast for Apr-Jun ’23 at 5 per cent and pegged it at 5.4 per cent for Jul-Sept ’23.

Moreover, the RBI additionally hiked repo price by 35 foundation factors to six.25 per cent in a bid to sort out inflation. This means that residence and automobile loans are more likely to get costlier.

He stated, “MPC has determined to extend coverage repo price by 35 foundation factors to six.25% with quick impact. I believe that is one event the place market expectations and MPC choices are by and enormous aligned.”

“MPC has additionally determined to proceed to stay centered on withdrawal of lodging to make sure inflation stays inside goal going ahead, whereas supporting progress” , Das famous.

The governor stated inflation stays excessive and broad-based internationally, including that the Worldwide Financial Fund (IMF) has projected greater than one-third of the worldwide economic system will contract both this yr or subsequent yr.

In the meantime, the World Financial institution stated India’s GDP is predicted to develop at 6.9 per cent in FY23 in comparison with 8.7 per cent in FY22. It added that India is affected by the developments within the US, Euro space, and China.

World Financial institution senior economist Dhruv Sharma stated, “India is extra resilient now than it was 10 years in the past. All steps taken over the previous 10 years are serving to India navigate the worldwide headwinds.”

India Rankings & Analysis chief economist DK Pant stated Q2 inflation and GDP numbers are in step with RBI’s forecast. In its September financial coverage committee assembly, the central financial institution predicted GDP progress at 7 per cent in 2022-23– 6.3 per cent in Q2 and 4.6 per cent every in Q3 and This autumn. The GDP progress for Q2FY23 slowed to six.3 per cent versus 13.5 per cent within the previous three months.

“Actual GDP or GDP at Fixed (2011-12) Costs in Q2 2022-23 is estimated at Rs 38.17 lakh crore, as towards Rs 35.89 lakh crore in Q2 2021-22, exhibiting a progress of 6.3 per cent as in comparison with 8.4 per cent in Q2 2021-22,” the Nationwide Statistical Workplace (NSO) stated whereas releasing the information on estimates of Gross Home Product (GDP) for the second quarter.

International score company Fitch saved India’s GDP progress forecast at 7 per cent in FY23, at 6.2 per cent in FY24 and 6.9 per cent in FY25. The score company stated, “India is predicted to document one of many quickest progress charges amongst rising markets.”

Housing.com Group CEO Dhruv Agarwala stated, “Whereas a slower GDP progress price and rising rates of interest are positively worrisome for all industries, so far as the realty sector is anxious, there could also be a short-term influence on the sector however its long-term progress stays intact.”

Additionally learn: RBI hikes repo rate by 35 bps to 6.25%

Additionally learn: Winter Session 2022: PM Modi likely to interact with media, Dr S Jaishankar to address parliament on day 1

[ad_2]