[ad_1]

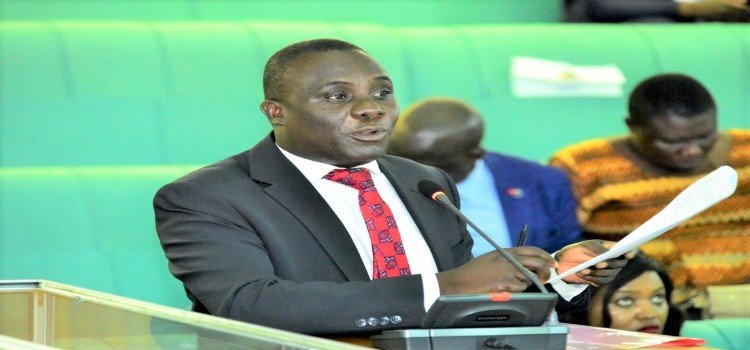

Butambala County Member of Parliament Hon. Muwanga Kivumbi has famous that authorities may very well be dropping properly as much as Shs8 trillion in tax exemptions, which he mentioned is senseless in gentle of budgeting constraints occasioned by pressures on the nationwide useful resource envelope.

“We’ve got nearly Shs8 trillion in tax exemptions; we’ve simply highlighted just a few; others are getting company tax holidays, that are taxes on income…they arrive right here, they get free electrical energy and land, after which they don’t pay tax,” he mentioned.

In a minority report, the shadow minister listed some entities towards the proposed exemptions they’re to get, which totaled to Shs588 billion, a determine he mentioned needs to be collected to finance the funds.

“If we are able to get well solely Shs4 trillion from the tax exemptions, we are able to steadiness our funds and implement it; it’s about time we launched an inquiry into tax exemptions in Uganda,” mentioned MP Muwanga Kivumbi.

On account of this, Deputy Speaker Tayebwa mentioned since there’s a committee established by Parliament to look into the tax exemptions for Bujagali Hydropower Challenge, the identical committee can look into all exemptions.

“We’ve got a committee to look into the tax exemptions of Bujagali; we should always not go into the funds cycle with out the report; you probably have finished a superb job, we will provide the different entities to additionally have a look at expeditiously in two weeks,” mentioned Tayebwa.

The bulk committee report referred to as for a go-slow on the practically Shs50 trillion projected funds for Monetary Yr 2023/24.

In its report on the Nationwide Funds Framework Paper offered, committee deputy chairperson, Hon. Ignatius Wamakuyu Mudimi, mentioned the useful resource envelope is probably not ample to cowl deliberate expenditures.

“…it will likely be obligatory to place planning and budgeting on a extra fiscally lifelike path because of the present international financial challenges,” mentioned Hon. Wamakuyu Mudimi.

Whereas the committee famous a projected Shs1.8 trillion improve in home income mobilisation efforts, it worries {that a} large chunk of the funds will go to debt and statutory funds, additional leaving close to to nothing for precise growth work.

Of the Shs49.9 trillion that shall be on the desk for distribution, already 64.1 per cent of that’s more likely to be channeled to debt and recurrent expenditure, leaving solely 35.9 per cent for growth expenditure, which has the potential of positively impacting financial progress.

“The proposed useful resource prioritisation may be very worrying and will point out that our fiscal operations is probably not sustainable in the long term as debt-related funds proceed to take the lion’s share of the funds,” he mentioned.

Even then, famous the committee, the largest chunk of the event funds goes into infrastructure, which the committee mentioned is probably not very sustainable in assuaging rising poverty and unemployment.

The main focus, mentioned the committee deputy chairperson, needs to be evenly placed on each human capital growth initiatives to enhance the standard of life.

“The committee recommends that there’s must strike a steadiness between and human capital growth in addition to re-engage growth companions particularly beneath the programme of human capital growth; investments in social sectors particularly well being, training and social safety have a direct affect on poverty and revenue inequality,” he mentioned.

Substantive debate on the matter is slated for Tuesday, 31 January 2023.

Do you’ve got a narrative in your neighborhood or an opinion to share with us: E mail us at editorial@watchdoguganda.com

[ad_2]