[ad_1]

The world is on the highway to “hyperinflation” and may very well be heading in direction of its worst monetary disaster because the second world conflict, in response to Elliott Administration, one of many world’s greatest and most influential hedge funds.

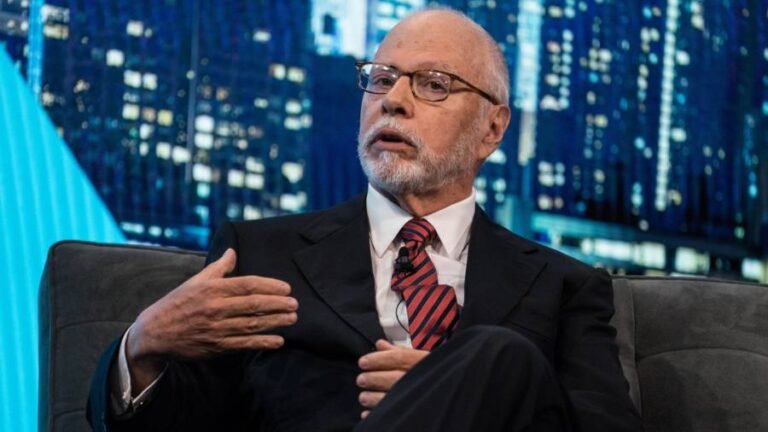

The Florida-based agency, which was based by billionaire Paul Singer and manages about $56bn in property, has warned its shoppers of an “extraordinarily difficult” state of affairs for the global economy and for monetary markets the place traders will discover it troublesome to generate income.

An “extraordinary” set of monetary extremes that come because the period of cheap money attracts to a detailed “have made attainable a set of outcomes that may be at or past the boundaries of the complete post-WWII interval,” it wrote within the letter, which was seen by the Monetary Occasions.

“Buyers mustn’t assume they’ve ‘seen all the things’” simply because they’ve skilled monetary crises such because the Seventies bear market and oil worth shock, the 1987 market crash, the dotcom bust or the 2008 monetary disaster, it added.

Elliott declined to remark.

The group’s warning comes throughout a dismal yr for markets, wherein international equities have shed $28tn in worth, in response to Bloomberg information, and bonds have additionally tumbled, leaving traders with few locations to hunt shelter.

The fund supervisor laid a lot of the blame for the looming disaster on central financial institution policymakers, which it mentioned had been “dishonest” concerning the causes of high inflation by blaming it on provide chain bottlenecks within the wake of the pandemic, relatively than on ultra-loose financial coverage put in place on the top of the coronavirus disaster in 2020.

The world is “on the trail to hyperinflation”, it mentioned, which might result in “international societal collapse and civil or worldwide strife”. Whereas such an end result isn’t sure, that is at present the route that the world was headed, it added.

Its warnings come as traders attempt to assess the financial harm prone to be felt from a fast collection of enormous interest rate increases within the US and elsewhere, as central bankers race to attempt to curb hovering inflation.

The S&P has dropped 20 per cent since its peak in the beginning of this yr, whereas the Nasdaq is down by one-third since its excessive a yr in the past.

Nevertheless, Elliott mentioned markets had not fallen far sufficient, given the various dangers current, and warned of an extra reversal of the so-called ‘all the things rally’ seen close to the highest of the bull market of latest years, as sky-high investor exuberance lifted all method of dangerous property.

There are such a lot of “horrifying and significantly destructive prospects” that it’s onerous to not assume that “a significantly hostile unwind of the all the things bubble” is coming, it mentioned.

The hedge fund estimates a 50 per cent fall from peak to trough could be “regular”, suggesting additional massive falls to return in main fairness markets, though it added it was not possible to know whether or not or when that may occur.

Elliott, which is up 6.4 per cent in 2022 and which has solely misplaced cash in two calendar years since launch in 1977, pointed to a handful of areas of potential stress that might speed up market falls. It highlighted banks’ losses on bridge financing, potential markdowns of collateralised mortgage obligations and leveraged non-public fairness as areas of potential danger for markets.

The agency was additionally important of traders who believed market falls will all the time show shortlived and could be “ignored”.

The concept that “‘we is not going to panic as a result of we now have seen this earlier than’ doesn’t comport with the present info”, it mentioned.

laurence.fletcher@ft.com

[ad_2]